direct vs indirect cash flow gaap

Alternatively the direct method begins with the cash amounts received and paid out by your business. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

The Statement Of Cash Flows Boundless Finance

The UCA cash flow model has become a standard for the lending industry.

. Sample Direct Reporting. UCA Cash Flow or Uniform Credit Analysis cash flow is a variation of the FASB95 direct cash flow format. Direct cash flow forecasting relies on the companys cash collections and disbursements to calculate cash flow.

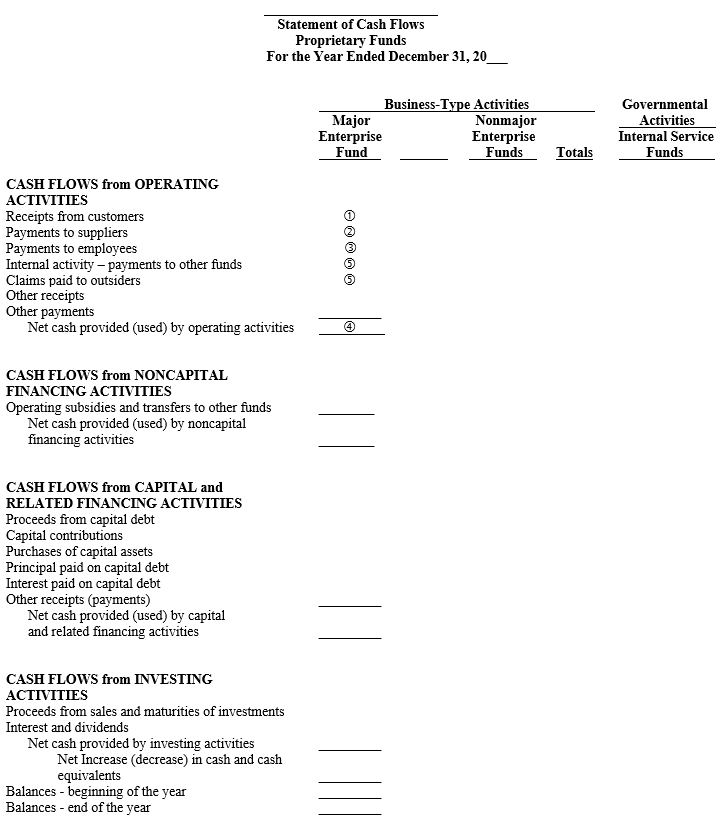

Under US GAAP defined benefit pension plans that present financial information under ASC 960 3 and certain investments companies in the scope of ASC 946 4 may be exempt from presenting a statement of cash flows. The starting point of the statement of cash flows varies under IFRS Standards. Indirect cash flow method is the type of transactions used to produce a cash flow statement.

108 In addition unlike IFRSs US. GAAP requires a reconciliation of net cash flow from. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business.

Direct Method GAAP UCA Cash Flow Model. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Most companies elect to prepare the Statement of Cash Flows using the indirect method.

We will look at both methods with the same data so you can see the. Irrespective of the method used to prepare the cash flow from operating activities section of the cash flow statement the cash flow from investing and. The direct method only.

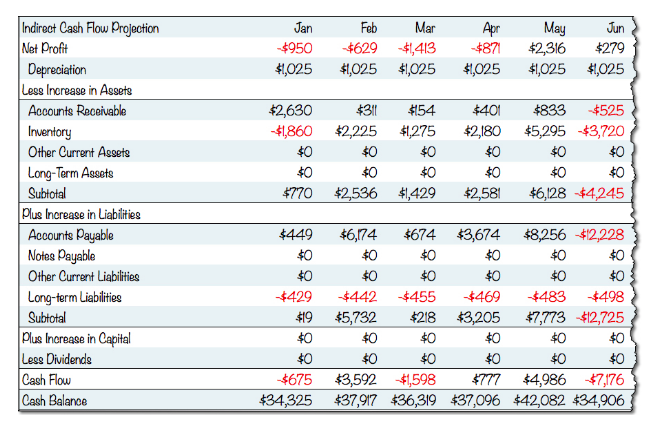

Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries. These units of time are then combined to the length of time that the forecast is set to cover. The indirect method works from net income so the bottom of the income statement and adjusts it to the cash basis.

Net income is the starting point under US GAAP. Ironically this is an equivalent of the indirect method. And statement of cash flows Exhibit 4 for a hypothetical NFP entity using the indirect methodThe NFP organizations governing board now desires a cash flow statement that better.

Interest received must be classified as an operating activity. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Statement of cash flows Keywords.

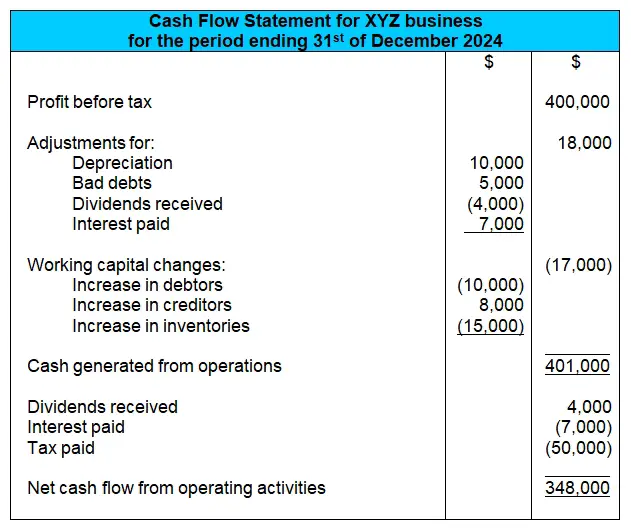

Direct Method or Income Statement Method. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No.

One of the key differences between direct cash flow vs. Here are the key differences between direct vs. It provides a slightly different view than the FASB 95 indirect and direct models.

Of cash flows or disclose in the notes to the financial statements the line items and. This is because if a company elects to present the Statement of Cash Flows under the direct method the company must then present a reconciliation of net income to cash flows from operating activities in the footnotes to the financial statements. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used.

Comparing the Direct and Indirect Cash Flow Methods. In the direct method reconciliation is used to separate various cash flows from others while in the indirect method the conversion of net income is done in cash flow. Main Difference between Direct and Indirect Method of SCF.

Also if a company. There are no presentation. Non-cash expenses like depreciation and amortization are ignored in the direct method while they are taken into consideration in the indirect method.

The inputs in direct cash forecasting are upcoming payments and receipts organized into units of time like day week or month. US GAAP also requires similar adjustments. GAAP also calls the indirect method the reconciliation method.

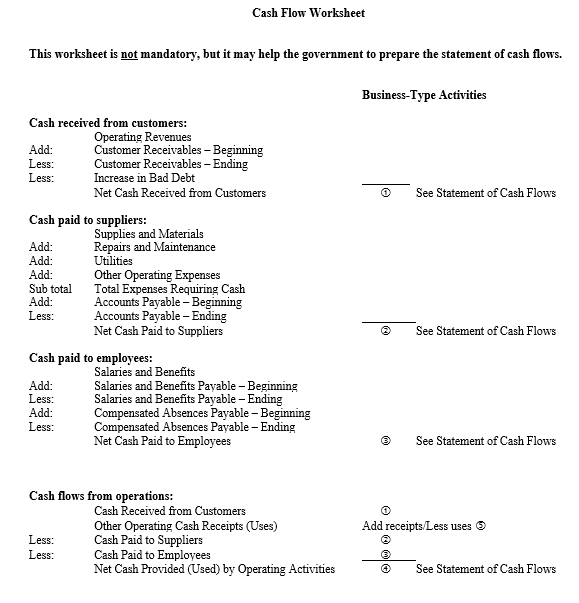

There are no differences in the cash flows from investing activities andor the cash flows from financing activities Under the US. 95 permit the direct and the indirect method of reporting cash flows from operating activities. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors.

Direct and Indirect Method for a Manufacturing Entity 230-10-55-10 The following is a statement of cash flows for the year ended. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. Statement of cash flows Subject.

Under US GAAP however when companies use the direct method they are required to present a reconciliation between net income and cash flow. The first four Exhibits show the trial balance used to develop the financial statements statement of activities Exhibit 2. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities.

However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations. Generally Accepted Accounting Principles GAAP and. Statement of position Exhibit 3.

106 Both encourage the use of the direct method. The indirect method begins with your net income. Indirect cash flow methods.

The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the. However of the two the direct method is generally encouraged.

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows Academic Resource Center Statement Of Cash Flows Page 2 Typical Coverage Of Us Gaap Purpose And Scope Content Format And Ppt Download

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

Statement Of Cash Flows Office Of The Washington State Auditor

Direct Vs Indirect The Best Cash Flow Method Vena

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Statement Of Cash Flows How To Prepare Cash Flow Statements

Statement Of Cash Flows Office Of The Washington State Auditor

The Indirect Cash Flow Statement Method

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Statement Of Cash Flows Boundless Accounting

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

27 Understanding Cash Flow Statements

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows How To Prepare Cash Flow Statements

27 Understanding Cash Flow Statements

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal